Canadian manufacturers lag behind those in other countries in adopting new technologies. This is the subject of reports by the BDC, the CME, and more recently, Manufacturing Automation. While these reports are helpful in highlighting a challenge, they are too often short on details regarding geographic and industry-based differences within manufacturing. (BDC, CME, Manufacturing Automation)

As some of our recent work highlights, manufacturing industries are diverse in many respects. They have different occupational compositions and varying levels of trade dependence and economic impact. The same applies to technology adoption.

In this bulletin, we draw upon data from two Statistics Canada surveys to explore the nuances of technology use and adoption on an industry-by-industry basis within Ontario manufacturing. The first, the Survey of Innovation and Business Strategy (SIBS), informs us on the use of ‘advanced’ and ‘emerging’ technologies and to what degree competition plays a role in these outcomes. The second, the Survey on Financing and Growth of Small and Medium Enterprises, helps us understand the reasons behind the reluctance to adopt such technologies.

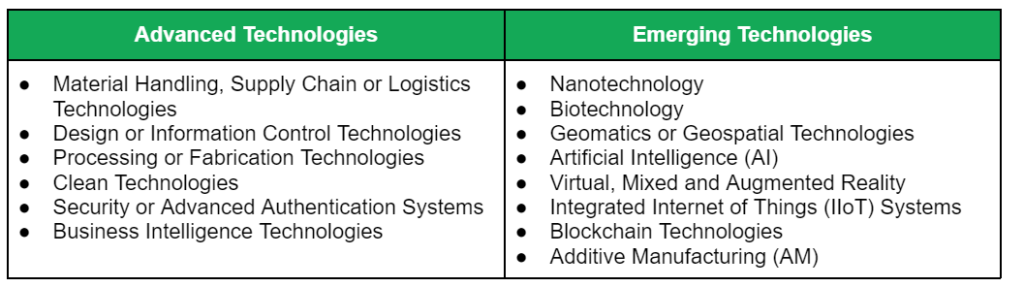

Statistics Canada defines advanced and emerging technologies as new technologies (equipment and software) that perform a new function or perform a function significantly better than the technologies commonly used in the industry or by competitors. Table 1 details the categorization of distinct technologies by Statistics Canada under this definition.

Table 1: Statistics Canada Categorization of Advanced and Emerging Technologies

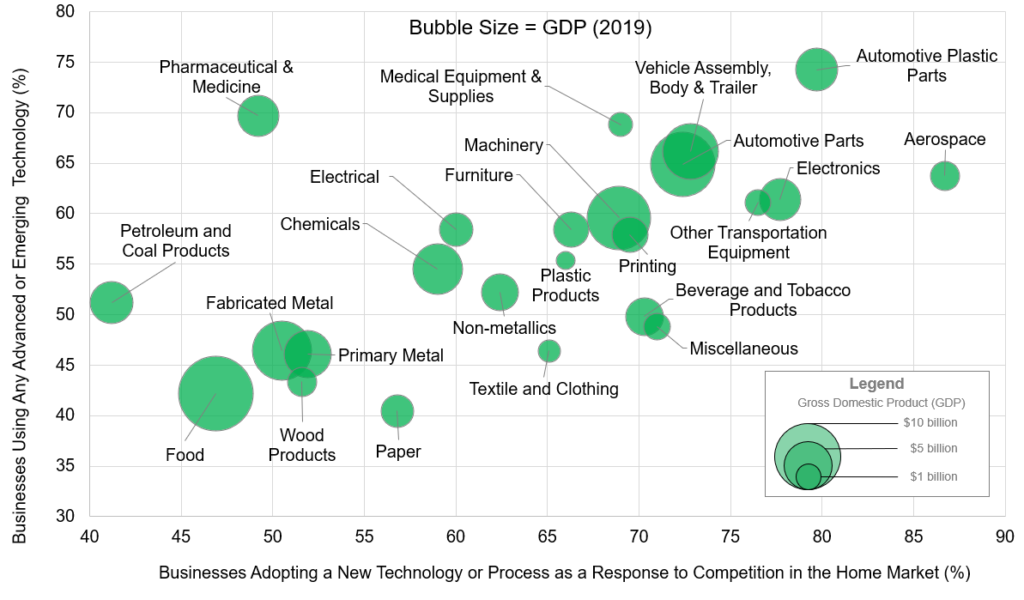

The figure below demonstrates the relationship between the level of advanced or emerging technology use in Ontario’s manufacturing industries and technology adoption in response to competition. This figure illustrates two key points. First, Ontario manufacturing is diverse in terms of the level of technology use at the industry-by-industry level. Automotive plastic parts, medical, pharmaceutical, vehicle assembly, automotive parts, and aerospace industries demonstrate considerably higher levels of advanced or emerging technology use. There is a large difference in the rate of technology use between some of Ontario’s largest manufacturing industries by GDP.

Figure: Advanced or Emerging Technology Use and Technology Adoption as a Response to Competition in Ontario Manufacturing Industries

Second, competitive pressures appear to be more strongly linked to technology adoption in the same industries that report higher levels of advanced or emerging technology use. For manufacturers in industries like aerospace, electronics, automotive plastic parts, and other transportation equipment manufacturing industries, new technologies may be a requirement of competition and survival. On the other hand, for manufacturers in food, rubber products, wood products, fabricated metal, and primary metal industries the link between competition and technology adoption is less clear.

One reason for this might be that these industries are also less trade dependent, meaning that they rely more on domestic supply chains for their inputs and a smaller share of their sales is exports (see Data Bulletin Number 3). Manufacturers in these industries may not be subject to the same level of global competitive pressures as those in industries like automotive and aerospace, leading to a lower technology use and adoption rate as a result.

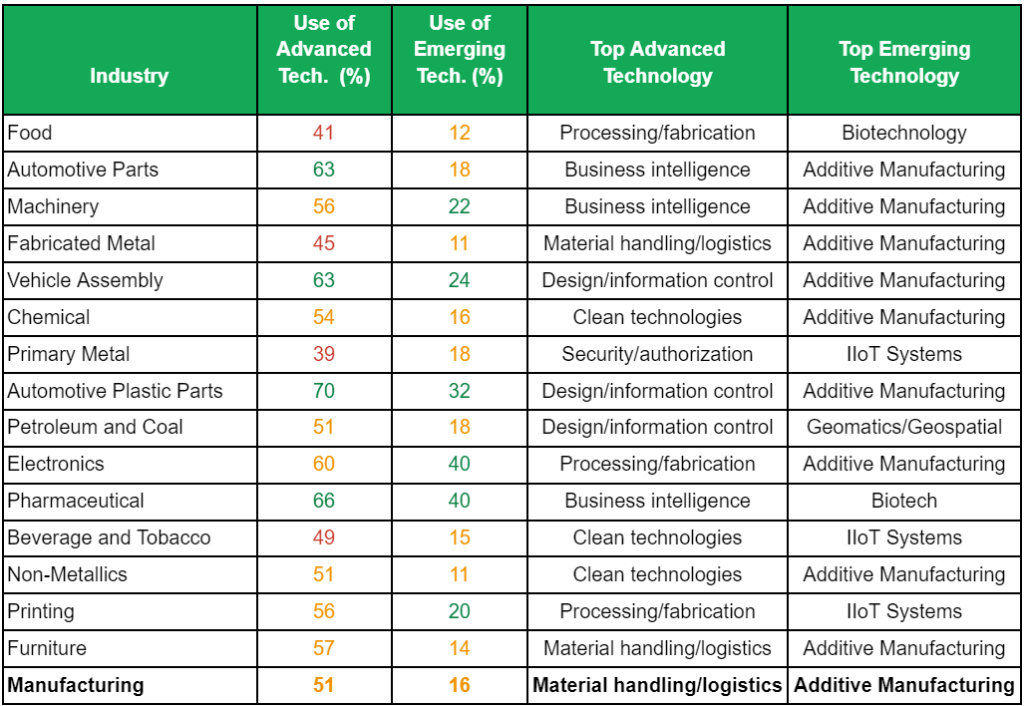

To better understand the nuances of technology adoption in Ontario manufacturing industries, we also need to examine the types of technologies adopted by manufacturers. In Table 2, we demonstrate an industry-level comparison of advanced or emerging technology use reported by select Ontario manufacturing industries alongside the technologies adopted in each category.

Table 2: Industry-Level Comparison of Advanced or Emerging Technology Use and the Most Common Technologies Adopted for Top 15 Ontario Manufacturing Industries by GDP

Additive manufacturing is the most common emerging technology adopted by manufacturers in Ontario. Biotechnology, IIoT systems and geomatics/geospatial technologies appear to be adopted by industries with more specialized needs. Another observation is that aerospace, machinery, electrical and printing industries have relatively high emerging technology uptake rates. In contrast, the automotive parts industry shows a weaker emerging technology adoption rate despite a relatively high advanced technology use rate. Stakeholders focused on increasing technology adoption among manufacturers need to consider these differences.

Finally, understanding the primary reasons for not adopting or using advanced technologies among Ontario manufacturing industries is key to fostering further technology use. The top reason is the perception that investment in technology is not necessary for continuing operations. This is followed by concerns about costs, which is common in industries that lag behind the Ontario sector average such as food, fabricated metal, and primary metal. In contrast, the biggest challenge Ontario manufacturers struggle with when they adopt or use new technologies is hiring talent with the necessary skills.

Key takeaways:

- Ontario manufacturing industries demonstrate varying levels of technology adoption and use, and the top technologies they have adopted also differ based on their needs.

- Advanced or emerging technology use is more common among industries that adopt technology as a way to respond to competition in their primary market.

- Efforts to boost technology adoption among Ontario manufacturers need to consider differences at the industry-level.