International trade has been the subject of much debate and discussion over the past few years. These have been related to a variety of factors, including supply chain challenges during the COVID-19 pandemic, shipping costs, protectionism, weather, and most recently, the conflict in the Ukraine. Amid all of this, it is absolutely critical to understand not only how important international trade is to manufacturers in Ontario and in Canada, but how those manufacturers are engaged and integrated into international production and consumer networks.

For many, if not most, manufacturers in Canada, international trade is vital. Manufacturers across the country serve as important suppliers of everything from beef to avionics within complex international production networks. But not every segment of manufacturing engages with international production networks to the same extent as others, nor is every segment of manufacturing as exposed to international trade in the same way. Many industries within manufacturing rely extensively on trade with the United States. Others are more reliant on the EU or Asia-Pacific regions. Some, however, rely primarily on markets within Canada (or even within Ontario).

This data bulletin provides initial insight into these relationships on an industry-by-industry basis. It draws primarily upon data from Statistics Canada and from Innovation, Science and Economic Development Canada’s (ISED) Trade Data Online portal.

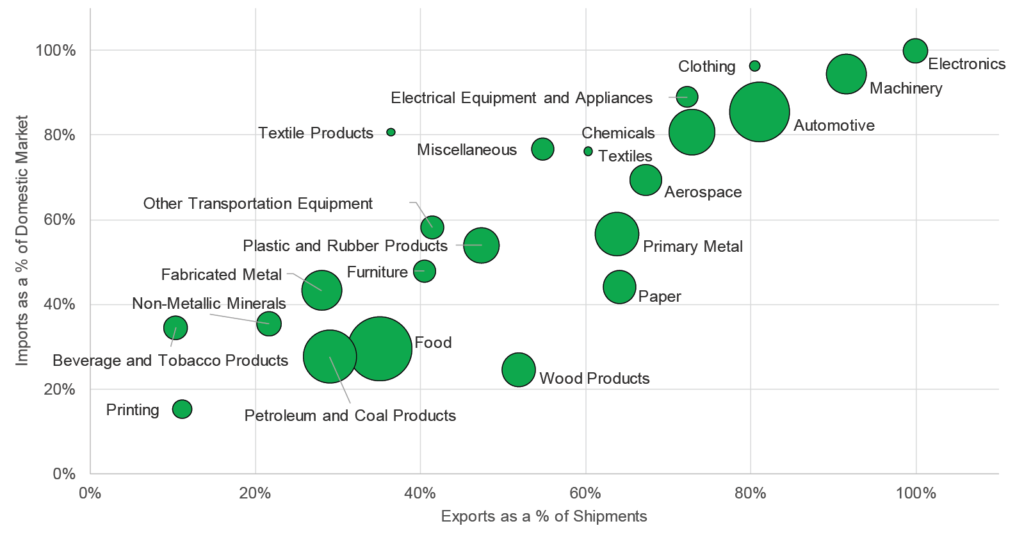

Trade Dependence, Select Canadian Manufacturing Industries

The transportation equipment industry, which includes automotive and aerospace, is the largest segment of Canadian manufacturing in terms of output and trade volume. This industry accounts for more than $135 billion in imports and $100 billion in exports annually. Approximately 90 per cent of motor vehicles sold in the domestic market are imported, while a similar proportion of vehicles made in Canada (primarily in Ontario) are exported (primarily to the United States). This is indicative of the highly-integrated nature of the North American automotive industry.

The aerospace manufacturing industry is slightly less trade-intensive than the automotive industry. Imports represent approximately 70 per cent of the domestic market for aircraft and related components, and exports represent a similar proportion relative to output. This is partly due to the continued Canadian presence of such aircraft manufacturers as Bombardier and De Havilland, as well as aerospace component manufacturers Raytheon Technologies, Magellan Aerospace and others.

Food is the second largest segment in terms of output. The food manufacturing industry, however, is not nearly as trade exposed as transportation equipment. Imports represent approximately 30 per cent of the food we consume in Canada, while about 35 per cent of the food produced in Canada is exported.

Some important manufacturing industries are almost completely exposed to international trade. Nearly all of Canada’s electronics output is exported as individual components or as part of finished products (e.g. a motor vehicle, plane, or medical device). Similarly, nearly all of the electronics consumed in Canada are imported. The same is true of Canada’s machinery industry.

Conversely, some segments of Canadian manufacturing are exposed to international trade only to a slight degree. For example, approximately one-third of beverages consumed in Canada are imported (and the majority of those imports are wine), while only 10 per cent of beverages produced in Canada are exported. The printing industry is similar, with imports representing approximately 15 per cent of the domestic market and exports representing 10 per cent of total output.

Key takeaways:

- Trade is important, but dependence on trade differs great by industry.

- Canada is more self-sufficient in some important industries than others, like food and beverage.

- Conversely, Canada is almost entirely dependent on imports of certain goods, such as consumer electronics.

- Understanding trade patterns and the dynamics of international production networks is

- important to any discussions around re-shoring and supply chain security.