Ontario’s manufacturing sector and related supply chains are constantly evolving, and have undergone significant changes over the past few years. The Trillium Network’s data bulletins provide insight into these changes and are designed to help stakeholders understand their impacts. In this bulletin, the fourth in our series, we explore the relationship between changes in the size of manufacturing facilities and changes in manufacturing employment.

Manufacturing facilities are diverse in size and scope. The largest in Ontario include ArcelorMittal Dofasco’s integrated steel mill in Hamilton and Toyota Motor Manufacturing Canada’s vehicle assembly complex in Cambridge, which each employ more than 5,000 people and contribute billions of dollars to provincial GDP. These are contrasted with hundreds of small craft-based manufacturers that produce anything from cabinetry to cheese to beer to medical devices. This diversity lends richness to Ontario’s advanced manufacturing ecosystem.

In some industries, such as steel-making, vehicle assembly, pulp and paper manufacturing, and oil refining, the nature of production is such that companies must achieve economies of scale, so virtually all work is done in large and well-capitalized facilities. For many others, however, production is carried out across facilities that vary significantly in size. In some cases, a growing proportion of production is concentrated in large facilities. In others, production has shifted away from large facilities into networks of smaller facilities.

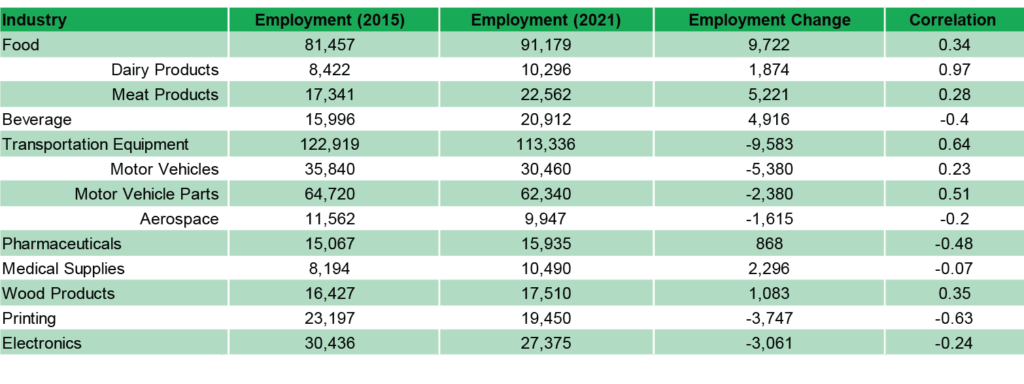

To better understand these changes, we draw upon Statistics Canada’s Business Count data and its Survey of Employment, Payroll, and Hours (SEPH), which we use to calculate the relationship between changes in employment and changes in the size of manufacturing facilities within manufacturing. The table below illustrates these relationships. A positive correlation signals that a growing proportion of production is concentrated within large production facilities (i.e. those with more than 200 employees). A negative correlation indicates that a growing proportion of production is occurring in smaller production facilities (i.e. those with fewer than 200 employees).

Employment Change and Large Production Facility Concentration Correlation (Select Industries), 2015 & 2021

Food manufacturing experienced the greatest growth in employment and in the number of large production facilities. This relationship was especially strong within the meat and dairy product manufacturing segments. Beverage manufacturing also experienced substantial employment growth, but the number of very large production facilities declined (as evidenced by the negative correlation). This is closely related to the growth of Ontario’s craft brewing industry.

Transportation equipment manufacturing experienced large decreases in employment, but a greater proportion of work being done in large facilities. In the case of motor vehicle manufacturing, employment losses across several companies did little to change the nature of production, which continues to occur in large facilities. The same is true of motor vehicle parts manufacturing, where the correlation is higher, indicating a more rapid concentration of production in large facilities. Aerospace manufacturing, conversely, experienced employment losses and a decrease in the proportion of production that takes place in large facilities.

Noteworthy changes affected several other industries. Employment in pharmaceutical product manufacturing increased, but the proportion of work that takes place in large facilities decreased. This may be the result of a number of new entrants that produce specialty biopharmaceuticals for locally-made COVID-related goods (e.g. antigens used in diagnostic kits). The same is true of medical supply manufacturing (i.e. PPE).

Wood product manufacturers, which sought to keep up with North American demand for construction materials during the pandemic, experienced increases in employment and in the proportion of work taking place in larger facilities. In printing, conversely, the proportion of work in large facilities fell considerably amid employment losses in the industry. This was likely due to the decrease in demand for printed materials as the result of more remote work and fewer in-person events during the pandemic. This was also the case in electronics, although the reasons for this are not as clear.

Key takeaways:

- Manufacturing industries are dynamic. The structure and organization of each industry can change considerably over time.

- A number of factors, including technology, trade agreements, supply chain disruptions, consumer demand, and public policy, can influence the structure of these industries.

- Being able to measure these changes using accessible and publicly available information is important for stakeholders and policy-makers who support manufacturing.