Investing in machinery and equipment is vital to the competitiveness of Ontario’s advanced manufacturing sector. These investments improve productivity, production capacity, and product quality. It is, therefore, important for policy-makers and other industry stakeholders to understand the trends related to these investments.

Analyzing manufacturers’ capital expenditures–especially those related to machinery and equipment–helps identify industries where productivity and competitiveness are likely to improve. It can also help identify those industries that are lagging behind. As a result, policymakers and industry stakeholders are better able to develop and augment programs and initiatives that are designed to leverage existing competitive advantages and address gaps and challenges.

This data bulletin examines capital expenditures in Ontario’s manufacturing sector between 2012 and 2021. Specifically, it aims to better understand capital expenditures across different manufacturing industries in Ontario over time. To do so, it draws upon Statistics Canada’s Annual Capital and Repair Expenditures Survey (Table 34-10-0035-01). While this survey includes data on capital expenditures related to construction and to machinery and equipment, our analysis focuses on machinery and equipment, which account for a large majority of capital expenditures.

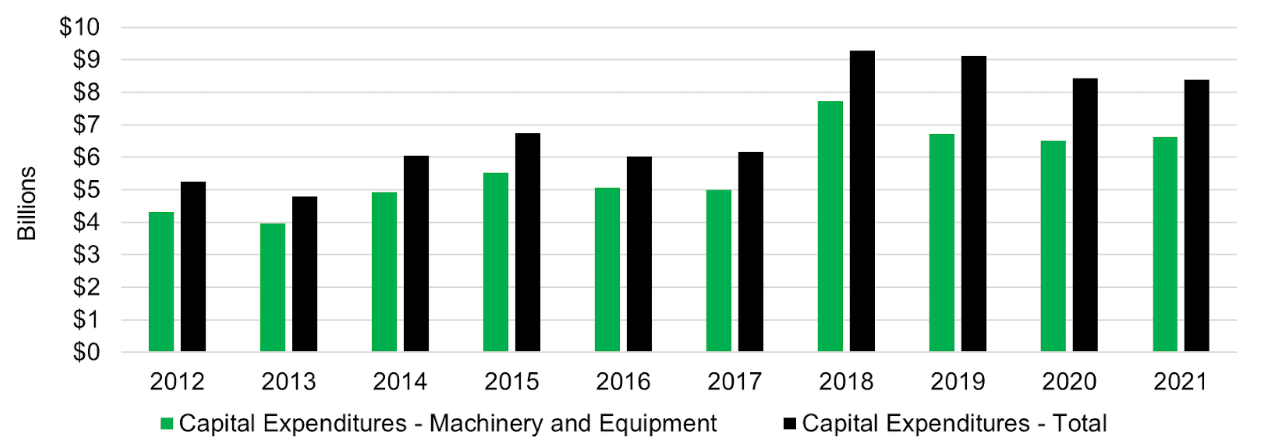

Figure 1 illustrates Ontario manufacturing capital expenditures between 2012 and 2021. It shows a marked increase in capital expenditures on machinery and equipment beginning in 2018–from an annual average of $4.8 billion between 2012 and 2016 to an annual average of $6.5 billion between 2017 and 2021–a promising sign for the future of manufacturing in Ontario.

Figure 1 – Ontario Manufacturing Capital Expenditures, 2012-2021

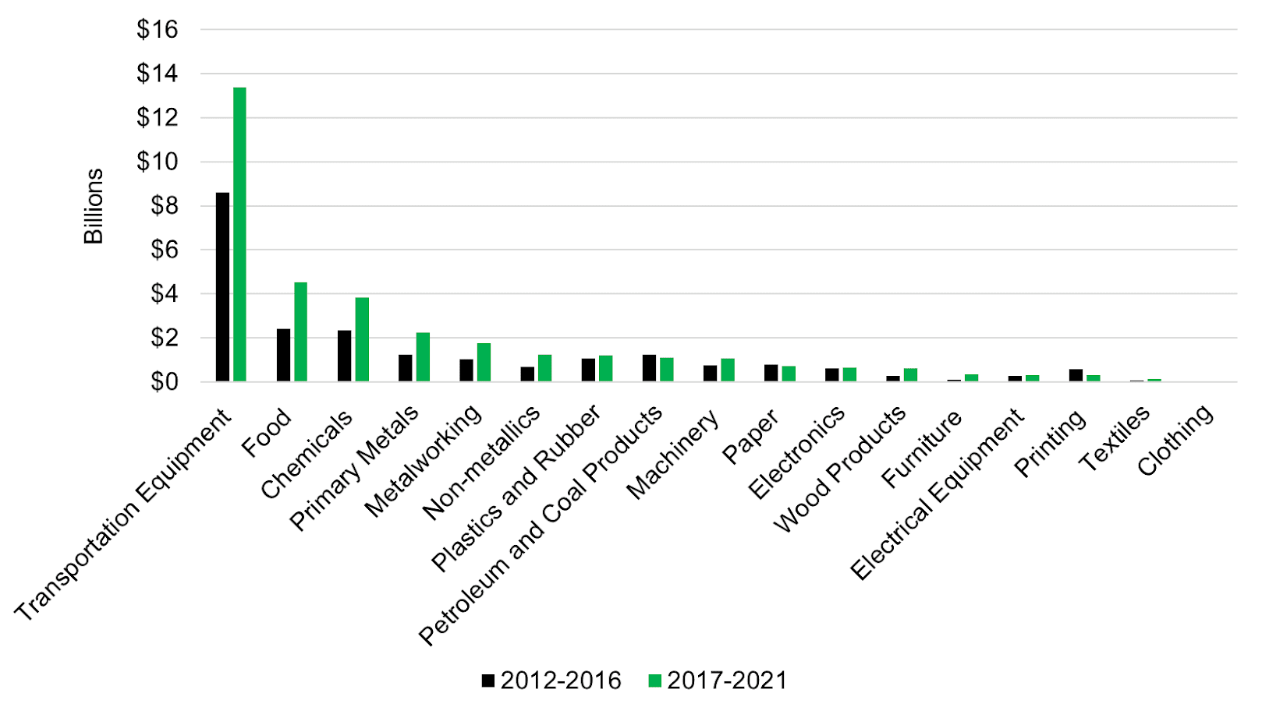

The increase in overall capital expenditures beginning in 2018 is due primarily to increased capital expenditures in the transportation equipment industry (Figure 2). The automotive industry accounts for a large majority of this spending, although the expenditures associated with aerospace manufacturing in Ontario are expected to increase beginning in 2022 as Bombardier and MDA bring new production facilities online. Capital expenditures in food, chemical (including pharmaceutical products), and metal manufacturing industries all increased substantially as well, although even when combined they do not equal those related to transportation equipment.

Figure 2 – Capital Expenditures (Machinery & Equipment), Select Industries

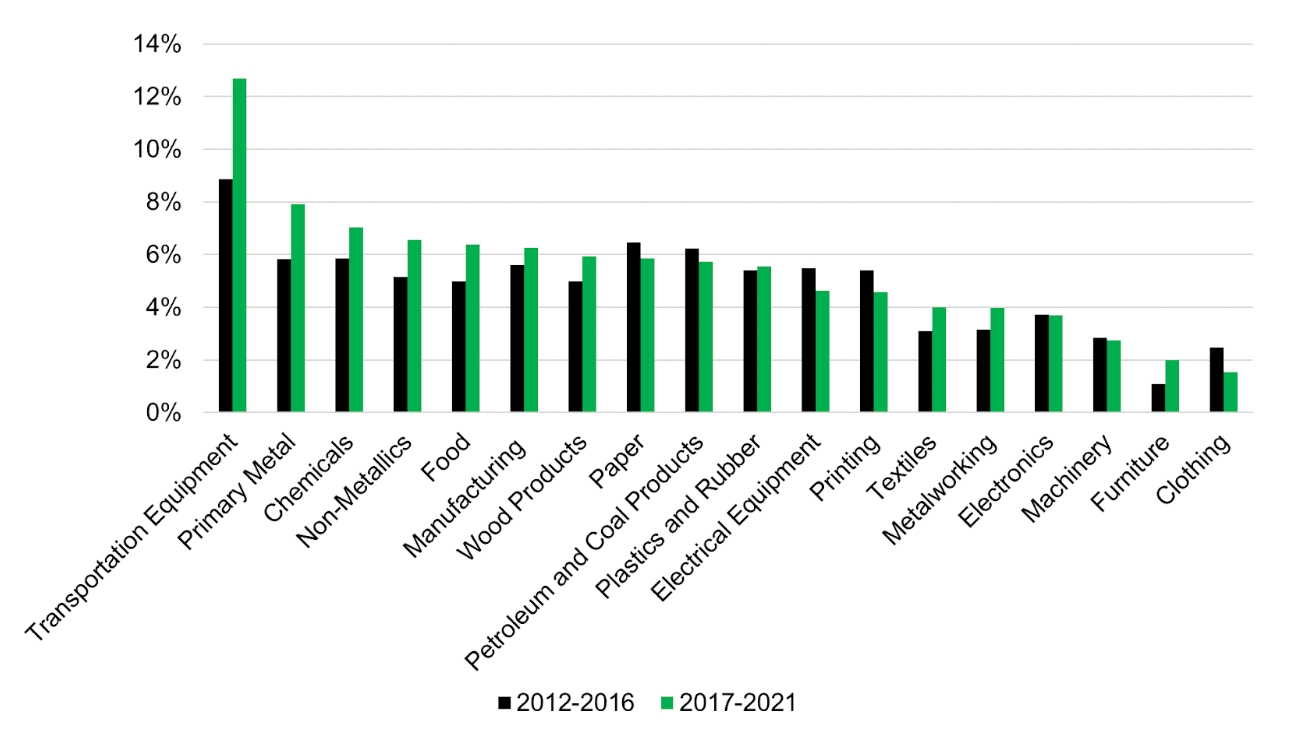

Figure 3 illustrates capital expenditures relative to nominal GDP in select Ontario manufacturing industries. This allows us to compare capital expenditures across industries while controlling for the relative size of those industries. Similar to Figures 1 and 2, Figure 3 shows that capital expenditures relative to GDP increased between 2017 and 2021 when compared to the period between 2012 and 2016.

Figure 3 – Capital Expenditures (Machinery and Equipment) as a % of Nominal GDP, Select Industries

These increases were most pronounced in transportation equipment, primary metal, and chemical manufacturing. Capital expenditures relative to GDP in Ontario’s substantial food manufacturing also increased considerably. This potentially bodes well for the future productivity of an important industry that long lagged many of its counterparts.

Interestingly, capital expenditures relative to GDP in Ontario’s machinery manufacturing industry appear to lag others. This, however, reflects the somewhat ironic nature of machinery manufacturing. Despite the importance of modern machinery to advanced manufacturing, even the most innovative and productive machinery manufacturers continue to rely on more labour-intensive processes. Many have, however, adopted digital technologies to support the design and production of advanced machinery and robotics. Investments in digital technologies are not captured in capital expenditure data, although they are the focus on other Statistics Canada surveys.

Key Takeaways

- Capital expenditures are crucial to understanding the evolution and trajectory of Ontario’s advanced manufacturing sector and its specific industries.

- Capital expenditures in most Ontario manufacturing industries were considerably higher between 2017 and 2021 than they were between 2012 and 2016. This is good news and improves the sector’s competitiveness moving forward.

- The most substantial capital expenditures were made in the transportation equipment, primary metal, and chemical manufacturing industries. These industries tend to lead the way in Ontario.

- The food manufacturing industry saw significant growth in its capital expenditures in nominal and relative terms. This bodes well for the future of food manufacturing in the province.