Canada’s trade relationship with the United States, and other countries, has received substantial attention since Donald Trump was elected President for the second time in November.

Much of this attention has focused on the potentially devastating effects of tariffs of up to 25 per cent on goods exported from Canada to the United States. These tariffs are expected to have outsized effects on the highly integrated automotive industry in both Canada and the United States.

This data bulletin is meant to provide background information, and hopefully clarity, on this important issue. It does so through an analysis of Canadian vehicle and automotive parts production, Canadian new vehicle sales, and Canadian vehicle and automotive parts trade. The bulletin, which is based primarily on Statistics Canada data, provides insight into the current state of the automotive industry in Canada, and on how it has changed over the past decade. This analysis is part of the Trillium Network for Advanced Manufacturing’s broader program of work related to Canada’s automotive industry.

Canadian Vehicle Production and Exports

By the end of the 1990s, Canada was the world’s fifth-largest vehicle producer. Only the United States, Japan, Germany, and France produced more vehicles. In 1999, Canadian vehicle production exceeded 3 million units. General Motors produced the most vehicles in Canada, by some margin, and manufactured nearly 1 million vehicles annually–cars and pickup trucks–in Oshawa alone.

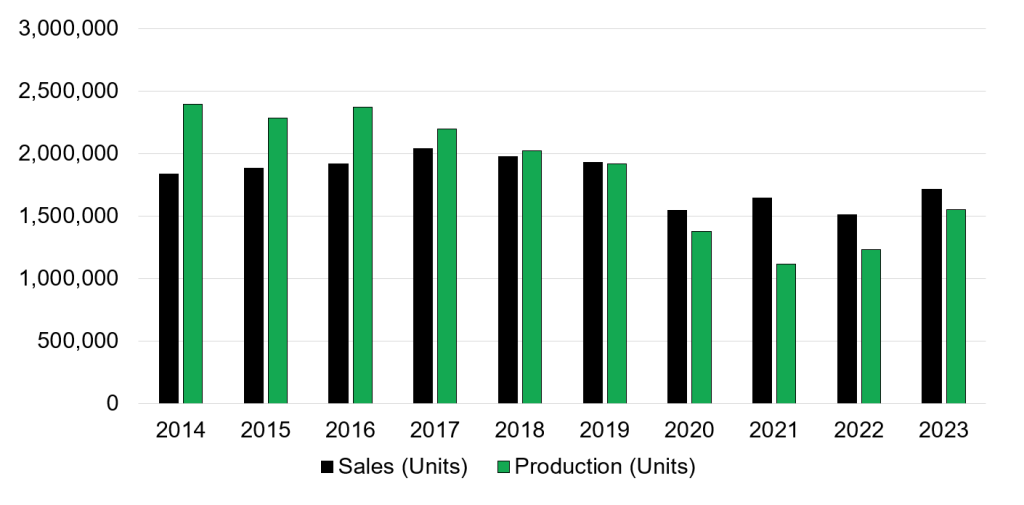

Annual vehicle production in Canada has decreased considerably since 1999. In 2014, automakers produced nearly 2.4 million vehicles in Canada. General Motors, Fiat-Chrysler, and Toyota all produced more than 500,000 vehicles in Canada in that year.

By 2023, output had fallen to 1.5 million vehicles, dropping Canada into the 10th spot among the world’s largest vehicle-producing countries. In 2024, that number will be closer to 1.3 million vehicles. This is because several Ontario assembly plants are idled or operating well under capacity. Over the past decade, Toyota and Honda have emerged as Canada’s largest vehicle producers. Together, those two companies will account for more than two-thirds of Canadian vehicle production in 2024.

Canadian Motor Vehicle Production and Sales, 2014-2023

Sources: OICA; Statistics Canada Table 20-10-0024-02

The United States is far and away the largest consumer of Canadian-made vehicles. In 2023, 88 per cent of vehicles produced in Canada by value were exported to the United States. This is an increase from 2014, when 84 per cent of vehicles produced in Canada were purchased by Americans. A large majority of the remainder–about 13 per cent in 2014 and nine per cent in 2023–were sold in Canada.

About one per cent of vehicles made in Canada were exported to China in 2023. Vehicle exports from Canada to other countries, including Mexico, were negligible. Canada’s export-based automotive industry is almost completely dependent on the United States.

Canadian Vehicle Sales and Imports

Canadians purchased 1.7 million new vehicles in 2023. This is less than the 1.8 million vehicles purchased by Canadians in 2014, and considerably less than the 2 million vehicles purchased in 2017. It is important to note, however, that Canadians spend much more per vehicle today than they did 10 years ago.

Half of the vehicles sold by value in Canada in 2023 were imported from the United States. This is a decrease from 2014, when 55 per cent of new vehicles sold in Canada were made in the United States.

Mexican-made vehicles accounted for 15 per cent of new vehicles sold by value in Canada in 2023. This represents an increase from 12 per cent in 2014. Mexico, which manufactured more than 4 million vehicles in 2023, is now the second-largest source of vehicles sold in Canada. It is increasingly a source of large pickup trucks and luxury SUVs. Mexico is an important source of vehicles, and Canadians are now far more likely to buy a vehicle made in Mexico than they are a vehicle made in Canada.

Canadian-made vehicles accounted for about nine per cent of sales by value in 2023. This is a decrease from 13 per cent in 2014. The proportion of Canadian-made units (i.e. individual vehicles) sold in Canada in 2023 was closer to 12 per cent. However, about three-quarters of the vehicles made in Canada and sold in Canada were more affordable models such as the Toyota RAV4, Honda CR-V, and Honda Civic.

Canada is thus the third largest source of vehicles sold in Canada. Japan (seven per cent), South Korea (six per cent), and Germany (five per cent) are the fourth, fifth, and sixth largest sources of vehicles made in Canada. Sales of Chinese-made vehicles, which were negligible until two or three years ago, accounted for two per cent of new vehicle sales in 2023.

Inflation-Adjusted Canadian Motor Vehicle Imports, 2014 vs. 2023

| 2014 | 2023 | |

| United States | $36.2B | $44.5B |

| Mexico | $8.3B | $13.6B |

| Rest of World | $12.7B | $24.0B |

| Total | $57.3B | $82.1B |

Source: Author’s Calculations, ISED Trade Data Online

Automotive Parts Production and Trade

Despite a decrease in vehicle production, the automotive parts manufacturing industry in Canada grew over the past decade. In 2014, automotive parts manufacturing contributed slightly more than $8 billion to GDP and employed 69,985 people. By 2023, automotive parts manufacturing GDP contributed more than $10 billion to GDP and employed 80,450 people.1

More than 43 per cent of Canadian-made automotive parts (by value) end up in Canadian-made vehicles. This is a slight increase from 2014. The destination of a small majority of these automotive parts were assembly plants operated by Toyota and Honda. This is a change from 2014, when assembly plants operated by Detroit-based automakers were the destination of a majority of domestic automotive parts shipments.

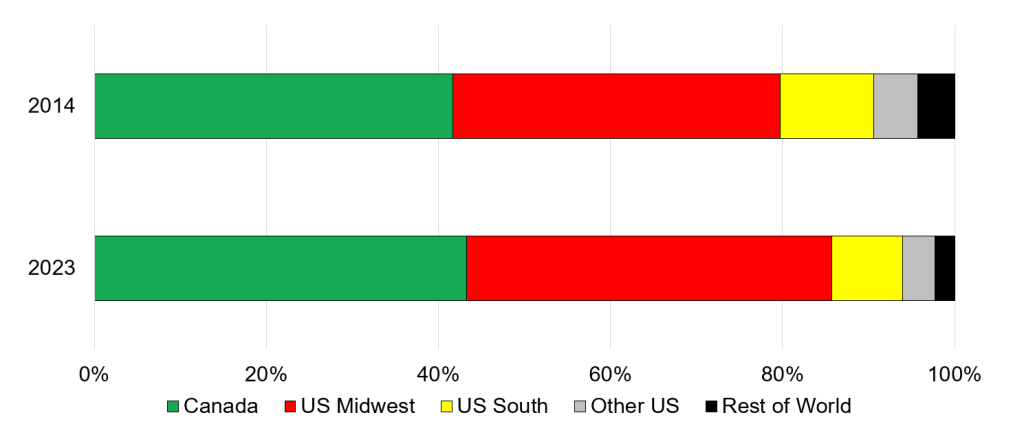

Destination of Canadian Automotive Parts Shipments, 2014 vs. 2023

Source: Author’s Calculations, ISED Trade Data Online; Statistics Canada Tables 16-10-0047-01 & 16-10-0117-01

About the same proportion of automotive parts made in Canada were shipped to the US Midwest (including but not limited to Michigan, Ohio, Indiana, Illinois, and, for the purposes of our analysis, Kentucky) in 2023. The majority of these parts are shipped to Detroit-based automakers in the region. The proportion of Canadian-made automotive parts destined for the US Midwest increased from 38 per cent in 2014 to 43 per cent in 2023.

The automotive-producing states in the southern US (including Texas, Tennessee, Alabama, Missouri, Kansas, South Carolina, Georgia, and Mississippi) were the destination of 8 per cent of Canadian-made automotive parts in 2023. This is a decrease from 11 per cent in 2014. This is somewhat surprising considering the rapid growth of the automotive industry in the southern US.

Canadian automotive parts shipments to other US states represented 4 per cent of total shipments in 2023, a decrease from 5 per cent in 2014. Canadian automotive parts shipments to Mexico accounted for more than 2 per cent of total shipments in 2014, but were negligible in 2023. Canadian automotive shipments to the rest of the world accounted for about 2 per cent of total shipments in 2014 and in 2023.

The inflation-adjusted value of automotive parts imports to Canada has increased over the past decade. The United States accounted for about 65 per cent of those imports in 2023, a decrease from 68 per cent in 2014. Automotive parts imports from Mexico increased from 12 per cent to 14 per cent between 2014 and 2023, and imports from China increased from 5 per cent to 6 per cent. Imports from the rest of the world were stable at 15 per cent.

Inflation-Adjusted Canadian Automotive Parts Imports, 2014 vs. 2023

| 2014 | 2023 | |

| United States | $30.8B | $30.3B |

| Mexico | $5.6B | $6.6B |

| China | $2.4B | $3.1B |

| Rest of World | $6.7B | $7.0B |

| Total | $45.5B | $46.9B |

Source: Author’s Calculations, ISED Trade Data Online

Key Takeaways

- Canada’s vehicle and automotive parts manufacturing industries depend almost entirely on trade with the United States, and the United States depends on Canada to supply it with vehicles and automotive parts.

- Canadians buy a lot of vehicles from the United States, and from other trading partners. In 2023, half of the vehicles sold in Canada came from the United States. About 25 per cent came from elsewhere in North America (i.e. Mexico and Canada). Most of the remainder came from Japan, South Korea, Germany, and China.

- The overwhelming majority–about 96 per cent–of vehicles imported to Canada come from countries covered by one or more trade agreements, such as CUSMA, CETA, CKFTA, and CPTPP.

- Tariffs, if implemented, would have significant negative effects on consumers and manufacturers in Canada and the United States.

1 Sources: Author’s Calculations, Statistics Canada Tables 36-10-0480-01 & 36-10-0402-01. Note: figures do not include NAICS 326193 (Motor Vehicle Plastic Parts Manufacturing), a category for which reliable data was not available. Previous estimates suggest that this sub-industry may account for an additional 10 to 15 per cent of employment and GDP.